The Policy Analysis Team at the Western Development Commission (WDC) has compiled a set of Timely Economic Indicators (TEI) for the Western Region (WR) and wider Atlantic Economic Corridor (AEC).

In this Insights blog post, I provide a commentary on the latest report.

Before delving into the TEI indicators it is important to discuss the general economic outlook.

General Economic Outlook

The previous TEI report noted encouraging signs for regional development caveated with potential risks such as inflation which have now been exacerbated by the Russian invasion of Ukraine. Recent events also pose major questions concerning the future sources of energy used across Europe. McHenry (2020) offers a study of what is needed for a transition to a low carbon economy in the rural Western Region.

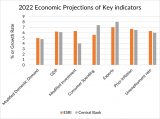

Figure 1 provides projections of the key macroeconomic variables for 2022 by the Central Bank of Ireland and ESRI made in March. Inflation expectations have been revised upwards to an average of 6% during 2022. It is expected that inflation will peak at 8% during the summer, the CSO has just released data for April 2022 with annual CPI rising 7%, a rate not seen for over 20 years.

High rates of inflation present a worry in terms of future growth and rising energy price inflation will pose significant challenges for rural households. Lydon (2022) studied December 2021 inflation data and found that although the headline inflation rate was high at 5.7%, inflation for rural dwellers was even higher at 6.2%. Half of the inflation rate for rural dwellers was attributable to energy (home energy/heating and personal transport)).

Strong growth is still expected in terms of modified domestic demand (probably the best indicator of underlying economic activity), consumer spending and exports although there have been downward revisions. The unemployment rate is also expected to continue to fall during 2022. These growth estimates are sensitive to future developments in relation to the war in Ukraine and thus may be revised downwards in Q2.

Rising inflation has led to monetary policy responses in the UK and USA where the central banks have raised interest rates. Just last week, the Bank of England raised interest rates to their highest level for 13 years. It seems likely the ECB will follow suit in the coming months, having been reluctant so far (as discussed in the previous TEI blog).

The ECB has been reluctant to raise rates as this could threaten the pandemic recovery. The ECB view has been that inflation was largely a transitory phenomenon driven by short term energy and pandemic related shocks. With inflation now becoming broader across categories the ECB is likely to act sooner rather than later to raise rates to try and curtail inflation.

Interest rates increases mean that investment would decline and consumer spending would be hit with higher mortgage payments. Mortgage rate increases have already been announced by some Irish lenders.

Labour Market

The combined share of the Western Region’s (AEC) labour force receiving the PUP, wage subsidy or on the live register fell to 18.7% (19.0%) at the end of March, down from 40% a year ago and 50-51% in May 2020.

However, regional and within region variation remains. For example, the share of the labour force in those categories combined, within the AEC counties, ranged from 15% in Roscommon (the lowest rate in the country) to 23% in Donegal and Kerry.

The regional and within region variation in the labour market has been documented by Lydon and McGrath (2020) and McGrath (2021) as a key feature of the pandemic period. Those studies suggest that the variation is related to, and has in some cases exacerbated, pre-pandemic regional structural issues within enterprise, employment, & economic activity.

Persons receiving the PUP continued to decline as the scheme unwinds. At the end of March, the share of the labour force in the Western Region & AEC receiving the PUP fell to 1.7%.

There has been an increase in live register numbers as the PUP and wage subsidy schemes unwind. The share of the labour force on the live register had been around 7.5% but this has risen to 8.2% in the Western Region & AEC at the start of May.

On 22 Jan. the PUP closed to new applicants, those not moving back into employment would be moved onto a jobseeker’s payment. The EWSS remained in place in a graduated form until 30 April 2022 for most businesses. For businesses directly impacted by the restrictions introduced in December 2021, the EWSS will end on 31 May 2022.

Consumption

During Q1 2022, new car registrations rose 3% in the Western Region, year on year. AEC registrations fell 1% over the same period. 2021 new car registrations and new goods vehicle registrations were above pre-pandemic levels in the Western Region & AEC.

Housing & Construction

The story of the housing market in 2021 was clear, housing demand held up well and continued to outpace supply thus prices have continued to rise. Figure 2 shows various estimates of annual sales price inflation with national growth of 8-15% and higher growth outside of Dublin of 12-17%.

The supply of available houses for sale rose during 2021 but from an extremely low base. The sales and rental price trends revealed similar patterns to suggest the pandemic has coincided with an initial movement away from larger urban areas, particularly Dublin.

These trends have continued into Q1 2022. However, for the remainder of the year, there are encouraging signs in terms of supply growth and there is likely to be mooted demand given rising interest rates and general inflation. However, rising borrowing and material costs will also threaten construction delays and the viability of residential units commenced and the scale of investment in future units.

These factors mean that expectations are that house price growth is likely to continue throughout 2022 in the high single digits (MacCoille et al., 2022).

The rental market in Ireland is facing a chronic shortage driving up prices. Annual rental price increases in Q1 2022 within the Western Region ranged from 4.8% in Galway city to 25.2% in Roscommon (the largest increase in the country). The national annual increase was 9%.

Lyons (2022) notes some astonishing numbers on the available supply of rental properties in the Q1 Daft rental report;

“On May 1st this year, there were just 851 homes available to rent nationwide ‐ down 77% year-on-year and a frankly unprecedented number…. The average number of homes available to rent nationwide at any point in time over the fifteen-year period 2006-2021 was nearly 9,200 ‐ over ten times the supply available currently.”

Lyons concludes that “in a rental market dogged by chronic and worsening shortage of homes, the only real solution is to increase the number of homes. With more pressure from certain quarters to stop new rental homes being built, policymakers must hold their nerve.”

The views expressed here are those of the author and do not necessarily represent or reflect the views of the WDC

Dr Luke McGrath

Economist

Policy Analysis Team