The Western Development Commission (WDC) has compiled a set of timely economic indicators for the Western Region (WR) and Atlantic Economic Corridor (AEC).

The fifth report in the series has been published today.

In this Insights blog post, I provide a commentary on the report.

As detailed throughout my recent presentation at the NERI Labour Market Conference, COVID-19 has exacerbated pre-pandemic structural issues in the WR and AEC. These issues include the structures of enterprise and concentrated employment in tourism-focused sectors. The regional dynamics of the COVID-19 economic shock are influenced by the pre-pandemic economic structures. Given these structures, it should be unsurprising in hindsight that the Western Region and AEC counties are severely exposed to the COVID-19 shock and associated lockdown measures.

As the economy begins to re-open there are encouraging signs of recovery.

Labour Market

PUP numbers have fallen to their lowest level since the onset of the pandemic. At the end of July, 30,165 persons received the PUP (7.8% of the labour force) in the Western Region, having peaked at 106,973 in May 2020 (27.6% of the labour force).

During the initial lockdown phases, last year, counties such as Kerry and Donegal were hit comparatively hard in the labour market with almost a third of their respective labour forces in receipt of the PUP. There has been a consistent decline in the numbers on the live register as well as those receiving the PUP or EWSS since February suggesting flows back into employment. The share of the labour force receiving the PUP in Kerry fell to 8.8% at the end of July, according to the latest Department of Social Protection data.

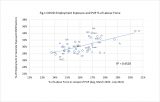

A key feature of the labour market impact of the pandemic has been the within-region variation observed with outlier counties such as Donegal and Kerry being hit comparatively hard. The within region variation is linked with COVID-19 employment exposure. Fig.1. shows that those counties with a higher share of employment in severely affected sectors have had a larger share of the labour force receiving the PUP (see McGrath, 2021 for details).

Throughout the pandemic, reopening phases have coincided with a sharper reduction in PUP claims within those counties initially more heavily impacted. Consequently, the within-region variation has subsided once again as the economy reopens and mirrors the experience of last summer.

Consumption

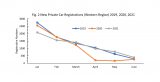

A sharp rise in new private car registrations during the second quarter of 2021 was observed. However, registrations in the first half (H1) of 2021 remain below pre-pandemic levels.

Fig.2 shows a comparison of new car registrations during 2019, 2020 and 2021 so far. Registrations in the Western Region were above 2019 levels in both May and June. Data for July will be highly informative as July, as well as January are the key months for new car sales due to the dual registration system.

New goods vehicle registrations in the AEC and WR were above pre-pandemic levels during H1 2021.

Housing and Construction

The first half of 2021 has seen a sharp increase in sales volumes (market transactions). The increase in transactions appears to be driven by a surge in demand as excess savings have been channelled into property, particularly in more rural and coastal locations.

Fig. 3 shows that sales volumes, in each month from February to May have been above 2019 levels in the Western Region.

While transactions are higher than 2019 levels, the supply of available properties has not kept pace with demand. The lack of supply nationwide has meant that the increase in demand has driven up sales prices and rents, particularly in rural and coastal areas (Gillespe, 2021; Lyons, 2021). The dynamics in the housing market are clear (on both rental and sales), demand has soared and supply has been constrained.

Demand has been boosted by the exceptional nature of the current economic shock. Large sections of the economy, particularly the higher income sectors, have been barely affected, in terms of income changes. With a constrained economy, in terms of areas to spend, a glut of savings has been accumulated and is, at least partly, being channelled into property. The Daft.ie market survey shows a big decline in those citing the deposit as being the biggest hindrance to buying a house (at one-third this was the lowest level in 10 years of surveying). Instead, the biggest barrier cited was the lack of supply.

The supply of new houses has been constrained due to public health restrictions but as Lyons (2021) notes it is the lack of supply in the second-hand market that is by far the biggest factor in terms of low supply levels. Lyons notes that from March to May the supply of second-hand homes was 22% below the average for 2015-19.

Housing demand appears to be concentrated away from cities and more urban areas and into more rural and coastal properties. Consequently, house prices in these areas have spiked. Lyons finds a 20% increase, year on year, in rural house prices during q2 2021. Gillespie (2021) using the Daft.ie database found an increase of 23% in the price for housing in coastal areas compared with a national average increase of 8.7%. A striking example is in the Letterfrack/Renvyle area in Connemara where the average house price for a 3-bed was found to be almost €270,000 having been below €200,000 pre-pandemic.

Lyons does point to several reasons for optimism of price stabilisation. Firstly, we might expect some of the backlog of second-hand properties to come onto the market following a relaxation of restriction and the end of the summer staycation season. Lyons notes that if there was a large increase in second-hand homes being listed and if city and urban office working makes a comeback then there may be a sharp reversal in price trends later this year. However, Lyons feels that it is more likely that we observe price stabilisation rather than reversals this year. Ultimately the longer-term outlook requires more than a recycling of second-hand properties and instead a sharp boosting of new supply is critical. Lyons argues “rather than cap the construction of new homes, as the government’s new Housing Need & Demand Assessment tool seeks to do, policy must do an about-face and look to boost the building of homes.”

The views expressed here are those of the author and do not necessarily represent or reflect the views of the WDC

Luke McGrath

Economist

Policy Analysis Team