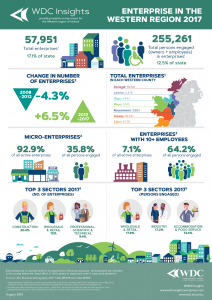

The WDC has analysed the latest CSO Business Demography data on enterprises in the Western Region. This data is for 2017 when there were 57,951 total enterprises[1] registered in the seven-county Western Region (location of an enterprise is based on its address as registered with Revenue[2]). In total, just over a quarter of a million people were working for enterprises registered in the region.

Enterprise in the Western Region 2017

The infographic shows some of the key indicators for enterprise in the Western Region.

The recession led to a 4.3% decline in the number of enterprises[3] in the region, this was compared to marginal growth in enterprises in the state (0.1%) over this period. With economic recovery, enterprise numbers grew again, rising 6.5% in the region between 2012 and 2017. While strong, this growth did significantly lag that nationally (11%).

As growth accelerated considerably between 2016 and 2017, it is likely that enterprise numbers have continued to expand since 2017.

Of all enterprises registered in the Western Region 92.9% were micro-businesses employing fewer than 10 people. This was a slightly higher share than nationally where 92.1% of enterprises are micro.

As each micro-enterprise is small in scale however, despite them accounting for 92.9% of enterprises, only 35.8% of everyone who works for an enterprise, works for a micro-enterprise. Of course, direct employment is just one of the economic and social impacts of micro-enterprises and they play a particularly vital role in smaller centres and more rural areas, as well as in particular sectors e.g. Construction, Professional Services.

By their nature, larger firms (employing 10 or more people) play a more significant employment role, accounting for 64.2% of everyone who works for an enterprise, despite only accounting for 7.1% of firms.

In terms of the number of enterprises, Construction is the largest sector in the Western Region accounting for 20.4% of all enterprises registered in the region. Wholesale & Retail (15%) and Professional, Scientific & Technical activities (9.4%) are next largest. All three sectors include many sole traders and micro-enterprises e.g. construction trades, solicitors, architects, small shops and they are also the three largest sectors nationally.

Considering the number of people working in enterprises however shows a different pattern. Wholesale & Retail is the largest enterprise sector in employment terms (17.8% of all people working in enterprises in the Western Region) followed by Industry (manufacturing) (17.2%) and Accommodation & Food Service (13.4%). These three sectors include many larger businesses e.g. factories, hotels, large retail stores, so account for a greater share of employment than of enterprises.

County Data

Data for the same indicators that are included in the ‘Enterprise in the Western Region 2017’ infographic has also been published for each of the seven western counties in a ‘Key Statistics’ one-pager. A few interesting findings for western counties:

- Roscommon and neighbouring Leitrim jointly have the highest share of micro-enterprises in Ireland (94.7%).

- While for most western counties Wholesale & Retail, Industry and Accommodation & Food Service are the three largest enterprise sectors for employment, for Galway and Roscommon, Health & Care is in the Top 3.

- At 9.9%, Donegal saw the largest decline in enterprise numbers in the Western Region between 2008 and 2012 with Mayo (5.3%) having the next largest decline. Sligo was the only western county where enterprise numbers increased over this period (0.9%).

- Clare had the strongest recovery in enterprise numbers between 2012 and 2017 at 10.4%, close to the national average (11%).

For anyone interested in more detailed analysis, a comprehensive ‘Profile of Enterprise in …’ document is also available for each county. Each 12-page Profile includes data on:

- Enterprise Trends 2008-2017: Active Enterprises and Persons Engaged

- Employees as a % of Persons Engaged 2008-2017

- Enterprises, Persons Engaged and Employees by Enterprise Size 2017

- Change in Enterprises and Persons Engaged by Enterprise Size 2008-2017

- Active Enterprises by Sector in 2017 and Change 2015-2017

- Persons Engaged by Sector in 2017 and Change 2015-2017

- Employees as a % of Persons Engaged by Sector 2017

Download the ‘Profile of Enterprise in …’ CLARE, DONEGAL, GALWAY, LEITRIM, MAYO, ROSCOMMON and SLIGO

Conclusion

Clearly micro-enterprises play a very significant role in the Western Region’s enterprise base. There is a higher share of owner-managers working in enterprises in the region which is important to keep in mind when designing and planning business supports. While enterprises in the region were hit very hard during the recession, there has been recovery, accelerating in recent years. There were more enterprises registered in the Western Region in 2017 than a decade earlier.

Enterprises form the backbone of the local and regional economy. Supporting the establishment and growth of sustainable enterprises across the Western Region is a key priority for the WDC and we hope that this analysis of enterprise data will help to better inform both ourselves and other organisations, individuals and policy makers, about recent trends in the enterprise base of western counties, including their vital role in job creation.

All documents are available from https://www.wdc.ie/publications/reports-and-papers/

Pauline White

Infographic designed by Resonate Design

[1] Data on total enterprises, total persons engaged and enterprises/persons engaged by Sector are based on a figure for ‘total enterprises’ which includes all economic sectors (NACE Rev2) except Agriculture, Forestry & Fishing and Public Administration & Defence.

[2] The geographical breakdown for enterprises is an approximation. The county breakdown is based on the address at which an enterprise is registered for Revenue purposes, rather than where the business actually operates from. In particular, where an enterprise has local units in several counties (e.g. a supermarket chain), but one head office where all employment is registered, all its employees are counted against the county where the head office is located.

[3] Data on enterprises and persons engaged by enterprise size (micro-enterprises etc.) and data on changes over time are based on a figure for ‘business economy’ enterprises which includes all economic sectors (NACE Rev2) except Agriculture, Forestry & Fishing, Public Administration & Defence, Education, Health & Social Work, Arts/ Entertainment/ Recreation and Other Services.