The Corona virus pandemic and consequent shutdown is bringing, and will bring, a massive economic shock globally, nationally and regionally, but the detail and scale of the consequences are not yet clear. There are many unknowns including in relation to its duration, and the speed and extent to which jobs will return once restrictions are lifted. Nonetheless, it is useful to consider, using available data, how the Western Region may be impacted.

In this short series of blog posts I look at some of our previous analyses of our regional economy and society from the perspective of the potential impacts of Covid 19, so that we can begin to consider areas of priority for support and for stimulation when opportunities once again become available.

Please note that this post was originally published on 30th March, and is being republished now but has not been updated. The data remains the most recent available and there will be discussion of more recently published analyses of the potential economic, employment and sectoral impacts of Covid 19 in future posts.

An overview of potential national impacts

The Quarterly Economic Commentary (QEC) recently published by the ESRI (26.03.20) notes that authorities response to the spread of the virus, while absolutely necessary from a general health perspective, will result in millions of jobs being lost globally in the coming weeks and months and a sharp contraction in global economic activity. They highlight that the swiftness of the economic deterioration is unprecedented in modern times and in many respects exceeds that of the financial crisis[1] (pg 1).

The ESRI examined the impact of the current restrictions on economic life with the assumption that the restrictions are in place over a period of 12 weeks. Under such a scenario the domestic economy would contract by 7.1 per cent and national unemployment increase significantly from 4.8 per cent in February to 18 per cent in Q2 2020 before falling back to just under 11 per cent by the end of the year (pg 2).

In this post I revisit some of the sectoral employment analysis carried out by the WDC insights team in the last few years from the perspective of the current economic shock, highlighting key areas of employment in the region and some potential implications of the crisis. The data is from Census 2016, collected almost four years ago and while there will have been changes since, it still gives a good picture of sectoral employment patterns in the Western Region.

Employment in high level sectors

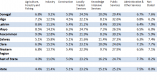

Differences between the Western Region counties and the Rest of the State[2] in sectoral employment is shown in Figure 1. In order to make the chart easier to read, some sectors have been grouped together to create these ‘high level sectors’ which give a useful overview of employment characteristics (see foot note for detail of what is included in each high level sector.[3]).

Figure 1: Percentage in total employment by high level sector in seven western counties, Western Region and the Rest of State

CSO, Census 2016 Summary Results – Part 2. Table EZ011. A table is also provided at the end of the post.

Public Services is the largest source of employment in all western counties. It ranges from 32.6% of all jobs in Sligo to 24.6% in Clare. Public Services includes Health, Education, and Public Administration.[4] Counties Sligo, Leitrim, Roscommon and Donegal are the four counties in the State with the highest shares of their population employed in Public Services. In the short term these public sector jobs will provide some employment stability, though employment in the childcare sector, which is included here, has been devastated.

The next largest employment sector in all western counties is Locally Traded Services which includes the three sectors Wholesale & Retail, Accommodation & Food Service, and Transport & Storage. These sectors are being very significantly affected by the shutdown and may face particular difficulties recovering.

The Western Region is weaker in Knowledge Intensive Services than the rest of the state. While there will be significant variation, many Knowledge Intensive services (Financial, Insurance & Real Estate, Information & Communications, and Professional, Scientific & Technical activities ) lend themselves to remote working and so employment may be able to continue in this sector during the shutdown.

Industry (largely manufacturing) is the third largest employment sector (see more discussion below). 15.8% of all jobs in Galway are in Industry, with Donegal having the second lowest share (9.2%) nationally.

The relative importance of different sectors varies in the seven western counties, though Public and Locally Traded services are the two largest employers in all. The dominant role of Public Services in the counties of the northwest shows the relative weakness of private sector activity in the area. Worryingly, five of the six worst performing counties in terms of employment growth between 2011 and 2016 (the period of recovery from the financial crash), are located in the Western Region. This vividly illustrates the job creation challenge still faced by the region and the importance of maintaining as many jobs as possible in the next few months.

In terms of the more immediate consequences of the Covid 19 shutdown, the high dependency on public service employment should provide more stable employment in the region in the short term but the lower level of employment in Knowledge Intensive services may make a return to economic growth more difficult. Some manufacturing, particularly in the medical device sector, may be well placed to benefit from the crisis.

There is more detailed discussion on sectoral employment pattern in Western Region counties in this WDC Insights post.

Detailed sectors Western Region and Rest of State

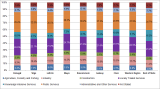

Combining sectors allowed us to see consider the county data more easily. However, it is important to look at employment in more detailed sectors and their importance in the Western Region to get a better understanding of potential employment consequences. The two long established patterns of greater concentration of employment (with more employment in fewer sectors) and more reliance on traditional and public service sectors in the Western Region are still evident in 2016 (Fig. 2).

Figure 2: Percentage of total employment in each broad sector in the Western Region and Rest of State, 2016

CSO, Census 2016 Summary Results – Part 2. Table EZ011

The Western Region’s jobs profile relies more on traditional sectors and public services. Industry’s share of total employment in the Western Region (13.7%) is considerably higher than in the rest of the state (11%). Manufacturing has consistently played a greater role in the Western Region’s jobs market and this intensified between 2011 and 2016. The region’s Industry sector has performed very strongly. The high-tech medical devices cluster is a major influence, employing 28% of everyone working in Industry in the region and growing by 30% since 2011. While many of the jobs in this medical devices sector may be maintained throughout the shutdown, and indeed there is some expansion in response to the crisis, other industrial jobs are more vulnerable.

Agriculture, Health, Education are other sectors that are more important in the region than elsewhere and are ones which are, in the short term at least, less likely to be affected by the shutdown (with the exception of childcare, which is included here). In contrast, Accommodation & Food service which accounted for almost 7% of employment in the region is likely to lose almost all employment in the short term.

The Knowledge Intensive Services sectors of Financial, Insurance & Real Estate, Information & Communications, and Professional, Scientific & Technical activities are all considerably larger employers elsewhere. Combined, they employ 9.7% of workers in the Western Region, but 16.2% in the rest of the state.

Conclusion

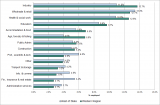

As the ESRI noted (Pg 10), there has been an almost total decline in certain types of economic activity from mid-March onwards. Many outlets particularly in the retail, food and hospitality sectors have simply stopped trading. This will inevitably result in a dramatic increase in the numbers of workers in these sectors being made unemployed. In particular, the wholesale and retail trade and the accommodation and food service activities, which together employed over 65,548 people in the Western Region in 2016 (almost 20% of the 333,919 in employment then), look set to lose a substantial number of workers over a very short period of time. Supermarkets, some food retailers and pharmacists are, however, increasing employment.

The pattern of employment in the Western Region compared to the Rest of the state has both positive and negative aspects in this current crisis. Higher dependence on Accommodation and Food services means more vulnerability but in the short term the greater reliance on public service employment will provide more stability and resilience.

Yet the dominant role of public service employment in the region is also an indication of the relative weakness of private sector activity and opportunities. The region’s slower recovery from the financial crash many mean it is more vulnerable in this crisis

If you are interested in reading more about the economic impacts of Covid 19 and government responses the ESRI scenario for the rest of the year is here. The OECD has updated their report Covid-19: SME Policy Responses. Potential business impacts and the pattern of business demography in the Region will be discussed the next post.

This series of posts brings together previous WDC analyses and examines them from the perspective of the possible impacts of the Covid 19 pandemic on the economy. The posts aim to develop our understanding of what may be happening at a regional level and what will need to be done after the public health emergency, but they are early interpretations and should be viewed as a work in progress rather than a definitive commentary.

Helen McHenry

The views expressed here are those of the author and do not necessarily represent or reflect the views of the WDC.

[1] Quarterly Economic Commentary Spring 2020

[2] Rest of state refers to all counties in the Republic of Ireland except for the seven counties of the Western Region (Counties Donegal, Sligo, Roscommon, Leitrim, Mayo, Galway and Clare.)

[3] Locally Traded Services includes Wholesale & Retail, Accommodation & Food Service, and Transport & Storage; Knowledge Intensive Services includes Financial, Insurance & Real Estate, Information & Communications, and Professional, Scientific & Technical activities; Public Services includes Health, Education, and Public Administration; Administrative and other services includes a wide variety of services including personal services, sporting activities, creative and other services.

[4] The Health and Education sectors also include substantial private sector employment e.g. private nursing homes, childcare, training providers. It is not possible to separate this out however.

Table of Data from Fig. 1.