The Western Development Commission (WDC) has just published the latest in its series of Regional Sectoral Profiles which analyse employment and enterprise data for economic sectors in the Western Region. This report examines the Administrative, Entertainment & Other Services sector, and two publications are available:

- Administrative, Entertainment & Other Services in the Western Region: Regional Sectoral Profile (39 page report, PDF 2MB)

- WDC Insights: Administrative, Entertainment & Other Services in the Western Region (2 page summary, PDF 0.2MB)

This sector includes three sub-sectors which provide services to both businesses and individuals:

- ‘Administrative & Support Services’ primarily provide ‘outsourced’ type business services (property management and landscaping, contract cleaning, ‘back office’ business processing/call centres, recruitment, leasing and security) but it also includes travel agents and tour operators;

- ‘Arts, Entertainment & Recreation’ (creative arts, cinemas, gyms, sports activities, amusements, museums and gambling); and

- ‘Other Services’ (hairdressing and beauty, laundry, repair services, funeral services, unions and business groups and domestic staff) mainly provide services to individuals and households.

Given the wide scope of this sector, it is particularly important to consider differences across the sub-sectors. Some of the key findings from the analysis are:

Sector plays a smaller role in Western Region’s labour market

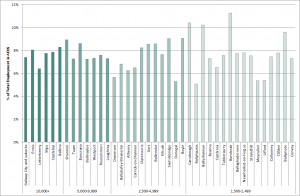

Administrative, Entertainment & Other Services account for a smaller share of total jobs in the region than nationally (Fig. 1); 6.5% of total employment compared with 7.5%. Large urban centres and global business services activity around Shannon influence its relative importance across western counties.

The region experienced lower jobs growth in this sector than elsewhere between 2011 and 2016 (8.9% compared with 13.6%). As this sector relies heavily on local demand, slower economic recovery in the region was a factor in this. Nevertheless as this sector grew more than total jobs in the region (7.5%), it contributed to the region’s jobs recovery.

High and growing self-employment

This sector in the region is characterised by a high rate of self-employment, both compared with elsewhere (27.6% in region v 21.5% in state) and with other sectors. This is particularly the case in more rural counties and for locally provided services (38.1% of all employment in ‘Other Services’ is self-employment).

The number of self-employed in this sector in the region increased by 19.4% (2011-2016), the highest growth across all sectors, as many individuals responded to growing demand by setting up small-scale service businesses (e.g. gyms, barbers, HR services, phone repair). Continuation of existing, and the development of new initiatives and soft supports, to support self-employment, including addressing issues of the quality and viability of some self-employment, is important particularly in smaller urban centres and rural areas where self-employment can be a key pathway to work.

Important contribution to town centre renewal

As online retailing grows, the availability and choice of local personal and recreational services is central to attracting people to visit and remain in town centre locations. Facilitating such services, many of which are provided by sole traders and micro-enterprises, should be integral to local plans for town centre renewal.

At 11.2% of all employment Bundoran has the highest share working in this sector of Ireland’s 200 towns and cities (1,500+ population), largely due to ‘Arts, Entertainment & Recreation’ (Fig. 2). Carndonagh (10.4%) and Ballyshannon (10.2%) are also in the top 10 towns in Ireland. Shannon meanwhile has the second highest share working in ‘Administrative & Support’ in the state.

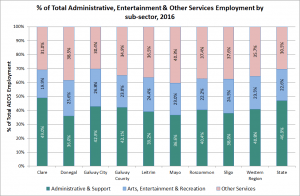

The structure of the sector in the region differs from the national picture

The mainly locally traded personal and leisure services are more important for employment in the region, with less activity in business services (Fig. 3). The single largest employment activity is ‘Hairdressing & Beauty’ which is significantly more important in the region than the state, the next largest is ‘Services to buildings & landscape’, followed by ‘Sport, amusement & recreation’. The greater importance of locally provided services means the sector relies more heavily on local demand and disposable income.

Some of the implications of this are:

- ‘Administrative & Support’ less developed but with growth potential: The ‘Administrative & Support’ sub-sector accounts for a lower share of total employment (see Fig. 3) and enterprises (33.5% of all AEOS enterprises v 35.8%) in the region than the state and also experienced lower growth. There is an opportunity to further develop this sector in response to increased outsourcing and strong growth in global business services. High quality communications infrastructure and property solutions, as well as improved accessibility and the availability of suitable talent are important factors. Within the region the Shannon Free Zone is a nationally significant location for global business services (e.g. aircraft leasing, e-commerce outsourcing). Strengthening this cluster to adapt to technological change, meet emerging skill needs and increase collaboration are among the actions needed to support this key regional asset.

- Local ‘Other Services’ more important and in particular for rural counties: These services largely rely on local demand and respond strongly to disposable income. As they are often consumed at the same location as they are supplied (e.g. hairdressing, dry-cleaning, nail bars), they play a particularly important role in the local economy of towns and villages. This sector however is generally quite low paid (at €17.13 per hour ‘Other Services’ has the second lowest average hourly earnings of all economic sectors.[1]) The greater importance of this sub-sector in the employment profile of the region therefore reduces the overall economic benefit of the sector to the regional economy.

- Role of ‘Arts, Entertainment & Recreation’ in the regional economy is growing: It experienced the strongest employment (13.6%, 2011-2016) and enterprise (12.6%, 2011-2016) growth in the region, in both cases expanding more than nationally. This sector is highly responsive to local disposable income with tourism a key driver. This is clear from its importance in locations such as Bundoran, Strandhill and Clifden. The Western Region is recognised as having a strong creative and cultural industries sector, as well as tourism industry. The WDC has supported the creative sector’s development through a range of initiatives[2] and the recent Regional Enterprise Plan for the West region[3] included it among its strategic objectives. Adopting a coordinated approach is critical to help realise the growth potential of the creative industries.

For more detailed analysis, including of enterprises in the sector and agency assisted jobs, download Administrative, Entertainment & Other Services in the Western Region: Regional Sectoral Profile here

Pauline White

[1] Only ‘Accommodation & Food Service’ is lower. CSO, Earnings, Hours and Employment Costs Survey Q4 2018, Table EHQ03

[2] See https://www.wdc.ie/regional-development/creative-economy/

[3] Department of Business, Enterprise & Innovation (2019), Regional Enterprise Plan to 2020: West Region